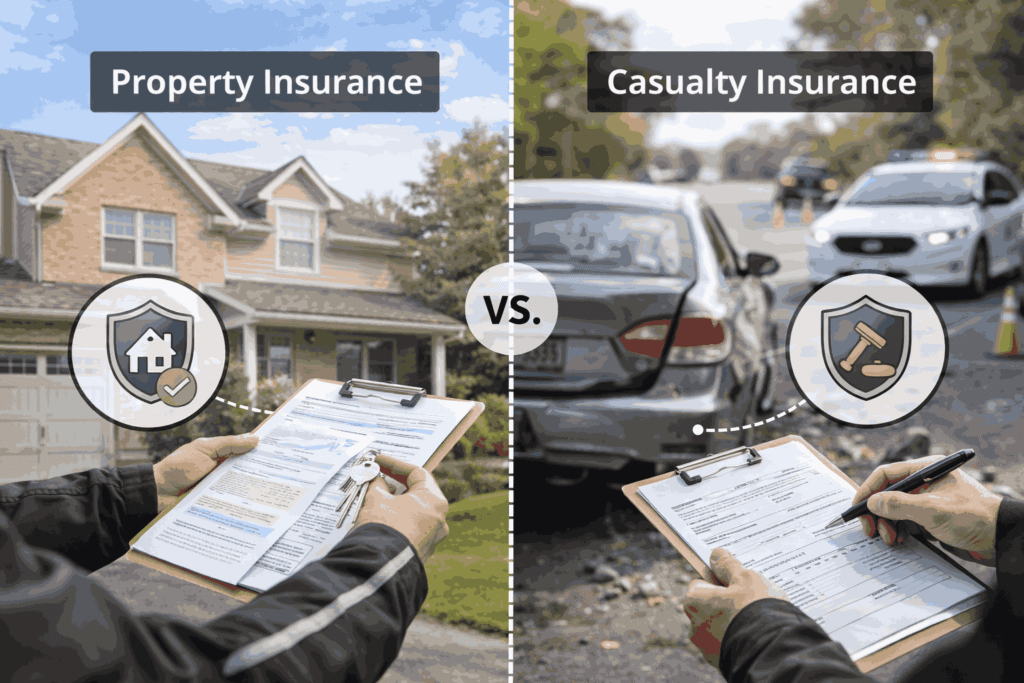

When protecting your assets, choosing the right coverage can feel overwhelming. Many confuse property insurance with casualty insurance. While both offer essential protection, they cover different risks. Understanding these differences helps you make informed decisions about your coverage needs.

Property insurance in Ontario protects physical assets you own. Casualty insurance covers liability when you’re responsible for injury or damage to others. Both types work together to provide comprehensive protection. Let’s explore how each coverage type works and why you might need both.

What Does Property Insurance Cover?

Property insurance protects your tangible assets from physical damage or loss. This coverage applies to buildings, contents, and personal belongings. For homeowners, this means your house structure, furniture, appliances, and other possessions receive protection.

A property insurance broker helps you identify what needs coverage. Typical perils include fire, theft, vandalism, and weather-related damage. Some policies cover additional risks like water damage or equipment breakdown. The coverage amount reflects your property’s replacement value, not its market value.

Property insurance in Barrie addresses region-specific risks. Severe winter weather, wind damage, and water-related issues require adequate coverage. Your policy should reflect local climate patterns and construction standards. Working with local experts ensures you don’t overlook important coverage gaps.

What Does Casualty Insurance Protect?

Casualty insurance focuses on liability rather than physical property. This coverage protects you when others suffer injuries or property damage due to your actions. It covers legal defense costs, medical expenses, and settlement payments.

Common casualty situations include slip-and-fall accidents on your property. Dog bites, accidental damage to the neighbour’s property, and injuries during social gatherings also fall under this coverage. Without adequate casualty protection, you could face significant financial exposure.

Most homeowner’s policies include liability coverage as a standard component. However, the amount varies between policies. Many Canadians carry $1-2 million in liability protection. High-net-worth individuals often purchase umbrella policies for additional coverage beyond standard limits.

How Do These Coverages Work Together?

A comprehensive insurance package combines both property and casualty protection. Your home insurance policy typically bundles these coverages together. This integration provides seamless protection for different risk scenarios.

When disaster strikes, both coverages might apply simultaneously. A kitchen fire damages your home (property claim) and injures a visiting friend (casualty claim). Having both coverages ensures complete protection without coverage gaps.

A property insurance provider designs policies that balance both elements. The premium reflects your coverage limits, deductibles, and risk factors. Geographic location, property age, and claims history all influence your rates.

Which Coverage Do You Need?

Most property owners need both types of insurance. Mortgages require property coverage to protect the lender’s investment. Casualty coverage protects your personal assets from lawsuits and claims.

Renters need different coverage than homeowners. Tenant policies cover personal belongings and liability but exclude building protection. Landlords carry separate policies covering rental property structures and loss of rental income.

Business owners require commercial policies with specialized property and casualty coverage. These policies address unique risks like customer injuries, professional liability, and business property damage.

How Much Coverage Is Enough?

Property coverage should equal your home’s replacement cost. This amount differs from the market value or assessed value. Replacement cost includes demolition, debris removal, and rebuilding at current construction prices.

Liability limits depend on your asset level and risk exposure. Working with a knowledgeable broker helps determine appropriate coverage amounts for your situation. Professionals with higher income or significant assets often require enhanced liability protection. Umbrella policies provide additional protection beyond base policy limits.

Regular policy reviews ensure your coverage keeps pace with property values and life changes. Home renovations, major purchases, and family changes all affect your insurance needs.

Finding the Right Protection for Your Needs

Selecting appropriate coverage requires professional guidance. Independent brokers access multiple insurance carriers to compare options. This approach ensures you receive competitive pricing without sacrificing coverage quality.

At Chapman Insurance Team, we simplify the insurance process for residents across Barrie, Alliston, and the surrounding areas. Our experienced brokers take time to understand your unique situation. We work with top insurance providers to find coverage that fits your budget and protection needs.

Don’t leave your property and financial security to chance. Contact the Chapman Insurance Team today. Let us help you build a comprehensive insurance strategy that protects what matters most to you and your family.